Published on June 23, 2020 by Preeti Rai

“If there’s one thing that is certain in business it is uncertainty”

Stephen Covey

The world we live in is changing rapidly, and the past two decades have been a turning point for compliance. Compliance requirements have been effective in assisting business operations and safeguarding stakeholder confidence. Compliance professionals play a key role in ensuring adherence to regulatory requirements; hence, preparing for the future is even more crucial from a compliance standpoint.

What is future-proofing?

Future-proofing refers to the process of anticipating needs and developing controls to reduce vulnerability to unexpected future occurrences.

How does it relate to compliance professionals?

The compliance function has taken on several risk-control responsibilities after the financial crisis of 2008, making it essential that the compliance officer review focus areas and develop a rational and cohesive approach to compliance. Therefore, it is critical to continue to invest in the skill set required in compliance functions, a vital ingredient for the growth and continued relevance of compliance professionals.

Top compliance challenges in 2020 and beyond:

-

Regulatory requirements

-

Compliance risk

-

Business ethics

-

Cybersecurity risk

-

Unforeseen living/working environments

Top essential skills for compliance professionals to be future-ready:

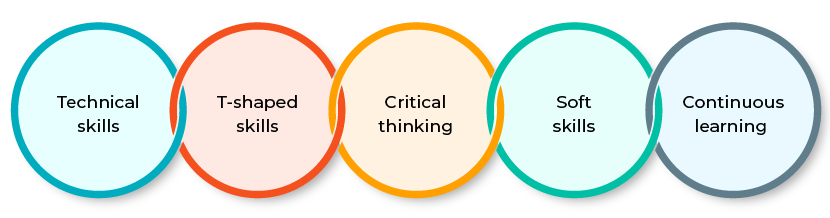

We cannot predict the future, but we can surely be prepared to face unforeseen challenges. Keeping in mind the next-generation workforce and the dynamic business environment, we list below the skills required for compliance professionals to be future-ready.

-

-

Technical skills: Technical skills such as automation, analytics, and artificial intelligence can help compliance professionals augment their judgment and insight to strengthen the effectiveness and efficiency of the compliance system. By implementing technical skills and developing a strong compliance culture, professionals can provide predictive insights and strategic counsel to leaders.

-

T-shaped skills: The T-shape theory was originally derived from the world of technology. In most organisations, compliance professionals are categorised into two areas, based on factors such as company size, individual experience, and expertise:

-

1. Generalist compliance professionals

2. Specialist compliance professionals

Generalist compliance professionals are those with a good understanding of a variety of compliance functions but expert in none. They generally operate horizontally, meaning that they get involved in various projects involving multiple skill sets.

Specialist compliance professionals operate vertically, or in an “I” shaped manner, meaning that they have significant experience in and knowledge about a specific area. They are often referred to as subject-matter experts, able to provide substantial input on a company’s compliance services.

What will happen if the generalist and specialist roles are merged?

We would arrive at a “T” shape, the horizontal line representing the generalist professional and the vertical the specialist professional. This would not only broaden the scope of the activities a professional could undertake, but also enhance the professional’s knowledge. It would not, therefore, be wrong to say that this is the shape skills will take in the future.

-

Critical thinking: This is a facet that current and future compliance structures demand. Exercising critical thinking in compliance duties would sharpen professional skills and enhance the quality of the outcome.

-

Soft skills: A compliance team’s soft skills are fundamental when assessing a company’s compliance strength. Compliance initiatives can succeed only if the professionals have soft skills strong enough to ensure implementation.

-

Continuous learning: Compliance professionals need to learn new skills to perceive matters in a new light and take the next step. Flexible, on-demand and continuous learning can help professionals deliver cutting-edge performance.

The way forward

Given the uncertainty of the future and the complexity of their roles today, it is vital that compliance professionals continue to refresh their knowledge and skills. The next generation of compliance can be built only if skills are upscaled. The three major takeaways from this blog:

-

Cost vs risk: The compliance industry costs around USD270bn a year, and banks have spent over USD321bn on enforcement actions, fines, and settlements since 2008 , according to a Bloomberg article. This shows that risk is evolving and that to remain risk stewards, companies need to continue to develop, strengthen and implement controls to detect non-compliance.

-

Collaboration vs separation: Growth of a company’s business is integral to the careers of all its employees. Compliance, being the second line of defence, is generally walled off from business units. Compliance service providers need to start collaborating with their company’s business, partnering them in decision making, rather than being part of workflow that mandates it. Doing so would maximise effectiveness and assist in risk mitigation.

-

Benjamin Franklin said, “An investment in knowledge always pays the best interest”. This statement stands true to this day. Reading and understanding regulatory requirements is important, and translating practical concepts into an ongoing control framework is the key to adding value. Hence, compliance professionals need to enhance their knowledge of their company’s business to create a value-driven high-support environment.

References:

Bloomberg: https://internationalbanker.com/technology/the-cost-of-compliance/

https://www.int-comp.org/insight/2019/future-proofing-the-compliance-professional/

https://internationalbanker.com/technology/the-cost-of-compliance/

https://internationalbanker.com/technology/spotlight-compliance-costs-banks-get-business-ai/

Tags:

What's your view?

About the Author

Preeti Rai has overall 4 years of experience in compliance & banking operations, having worked for various firms including State Street Global Advisors and Northern Trust her expertise spans across Compliance, Policy monitoring and Risk surveillance . At Acuity she is responsible for monitoring Code of Ethics for a client. Preeti has completed her Masters in Commerce from Christ University, Bengaluru

Like the way we think?

Next time we post something new, we'll send it to your inbox