Published on December 10, 2020 by Dilshani Amarasinghe

The need for alternative sources of funding is felt like never before, further pressured by banks racing to expand their lending portfolios amid the pandemic. Among such alternative sources, wholesale funding[1] holds a vital position in a bank’s funding structure, as it enables considerable maturity transformation, given its short-term nature, and is, therefore, preferred regardless of its inherent drawbacks and high risk exposure.

The downside of wholesale funding

Banks with an overdependence on wholesale funding could be at risk of failure amid a potential credit crunch, primarily caused by asset and liability mismatches, exposing them to sudden liquidity shocks. Furthermore, wholesale funds would shrink a bank’s yields regardless of how steep the yield curve is, and possibly lead to liquidity shortages if funds are withdrawn within a short period of time, ultimately resulting in bankruptcy.

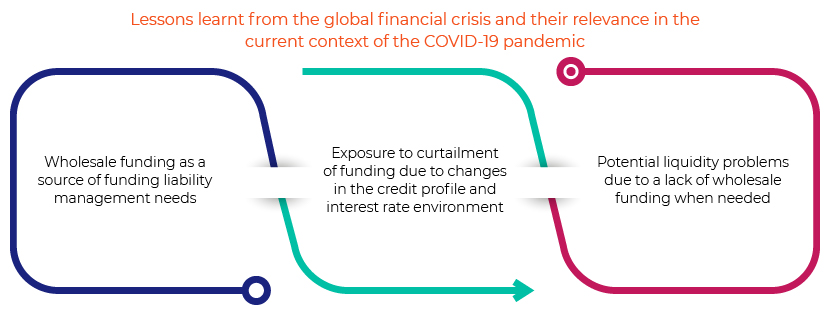

Lessons learnt from the global financial crisis and their relevance in the current context of the COVID-19 pandemic

Source: Acuity Knowledge Partners

Studies indicate that overdependence on wholesale funding, as a source of funding liability management needs, was among the main reasons for the 2007-08 global financial crisis and the collapse of Northern Rock (once the fourth-biggest bank in the UK), Continental Illinois (once the seventh-largest commercial bank in the US) and Bear Stearns (subsequently sold to JPMorgan Chase). The sudden increase in wholesale withdrawals against the backdrop of the subprime mortgage crisis, paired with significant asset and liability mismatches resulting from the unprecedented securitisation of mortgage products, was seen as the key reason for such failures.

[1]Wholesale funding refers to a bank’s large institutional deposits or additional sources of funding to finance operations in addition to its core retail deposits such as demand and savings deposits

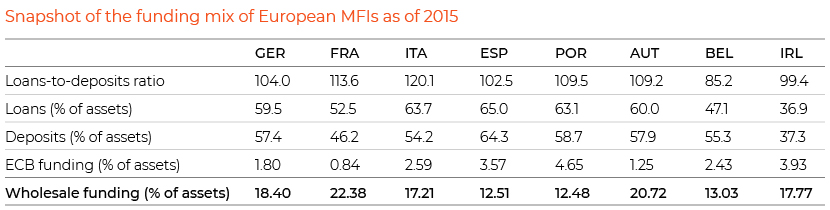

The adverse effects of overdependence on wholesale funding due to the ongoing pandemic have yet to be reflected in the global banking system. As indicated in the European Central Bank’s Financial Stability Review in May 2020, Germany and France rely more on wholesale funding than Italy and Spain, primarily through non-financial corporation deposits. According to a recent report by S&P, banks in the Middle East, Turkey and Africa (META) seem somewhat dependent on wholesale funding through foreign inflows from nationals living overseas. META banks’ deposit mix consists of an average of 70-75% of retail deposits; however, this percentage is relatively low in Turkey (50-60%) and much lower in countries such as Jordan, Lebanon and Morocco that rely significantly on wholesale foreign remittances from citizens overseas. Nevertheless, if the current social restrictions persist for longer, wholesale funders could withdraw deposits to fund expenses, making wholesale funding a “swing factor” of a bank’s stability.

Source: The Federal Reserve (2019)

As banks edge forward…

Wholesale funding is perceived as an effective tool to accelerate a bank’s lending growth, although this requires the right mix of funds and correct risk management strategies. Banks have implemented the following key strategies on wholesale funding to mitigate risk after the global financial crisis.

-

Rebalancing the funding structure: Banks have taken measures to diversify their wholesale funding portfolios by strengthening their service offerings to retail clients. Furthermore, to attract retail deposits, central banks have introduced or enhanced their existing deposit guarantee schemes (DGSs) to rebuild trust, safeguard retail depositors and restore market confidence. Countries such as Australia and Singapore were new to introducing DGSs, while the US and Spain increased their current DGS limits, whereas Germany and Ireland introduced unlimited insurance coverage. The EU adopted a directive in 2009 for EU countries to introduce a DGS of a minimum of EUR50,000 and further increase it to a uniform level of EUR100,000 in the future.

-

Reducing maturity mismatches: Banks are now focused on identifying more appropriate sources of funding to manage maturity mismatches. For instance, at present, banks are minimising maturity transformation by securitising mortgages via more stable sources such as bonds and pension funds. Establishing specialised intermediaries where most of the risk is assumed directly by investors is also used as a method of reversing maturity transformation and moving long-term assets away from bank funding.

-

Deleveraging: Deleveraging strategies generally involve streamlining loan portfolios through the disposal of non-core loans and distressed property assets to achieve loans-to-deposits ratio targets. These disposal proceeds, along with any raised capital, are thereafter converted into capital buffers to be maintained and utilised in times of liquidity shock. The most significant deleveraging step taken to date is the establishment of the National Asset Management Agency (NAMA) in 2009 by the Irish government to acquire EUR74bn of bank loans from participating institutions at an average discount of 57%.

-

Regulatory improvements: With the formulation of the Basel III accord, multiple reforms have been introduced by regulators around capital, liquidity and leverage requirements. The introduction of the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR) has encouraged banks to hold sufficient high-liquid assets while maintaining additional amounts of stable funding.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) can help banks implement proactive measures to avoid potential pitfalls associated with wholesale funding. We can help achieve optimum maturity periods for both assets and liabilities in bank portfolios.

We also provide assistance in terms of identifying yield mismatches between wholesale depositors’ expected yield and the ideal interest spread quoted by a bank; this could help prevent sudden wholesale withdrawals that result in liquidity problems.

We also prepare scenario analysis models, which include risk-based pricing calculations considering the costs associated with sources of wholesale funding.

References:

https://www.bis.org/bcbs/events/rtf08rtmfs/huangratnovski.pdf

https://www.investopedia.com/articles/economics/09/when-wholesale-funding-goes-bad.asp

https://www.bbc.com/news/business-41229513

https://www.federalreservehistory.org/essays/failure_of_continental_illinois

https://www.ecb.europa.eu/pub/pdf/other/eubanksfundingstructurespolicies0905en.pdf

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1884.en.pdf

https://www.ecb.europa.eu/pub/financial-stability/fsr/html/ecb.fsr202005~1b75555f66.en.html#toc21

https://www.federalreserve.gov/econres/ifdp/files/ifdp1245.pdf

https://corporatefinanceinstitute.com/resources/knowledge/finance/basel-iii/

http://documents1.worldbank.org/curated/en/548031537377082747/pdf/WPS8589.pdf

https://www.newyorkfed.org/newsevents/speeches/2013/dud130201.html#footnote3

Tags:

What's your view?

About the Author

Dilshani Amarasinghe has over 6 years of experience in commercial lending and currently works as a Delivery Lead attached to the Commercial Lending Division at Acuity Knowledge Partners. She supports the Commodities, Food and Agriculture sector of a leading European bank, undertaking the validation and monitoring of covenants, financial spreading and performing risk ratings. Prior to joining Acuity Knowledge Partners, she worked as an Assistant Relationship Manager attached to the SME credit sector in a Sri Lankan bank. Dilshani is an Associate Member of Chartered Institute of Management Accountants (UK). She holds a Master’s Degree in Financial..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox