Published on August 11, 2020 by Faisal Riyaz

Pandemics, natural disasters and wars have been part of our existence. History shows that amid the accompanying economic setback and loss of life, such events not only reveal weaknesses in the system but also accelerate positive trends. The 1918 pandemic led governments to consolidate and centralise public health systems that until then were fragmented at most. More recently, the 2004 earthquake in the Indian Ocean led countries to collaborate and implement a Tsunami Warning System that helped save lives when a deadly tsunami struck again in 2012. The COVID-19 pandemic has underscored how connected we are to our environment and that we need to live in harmony with nature.

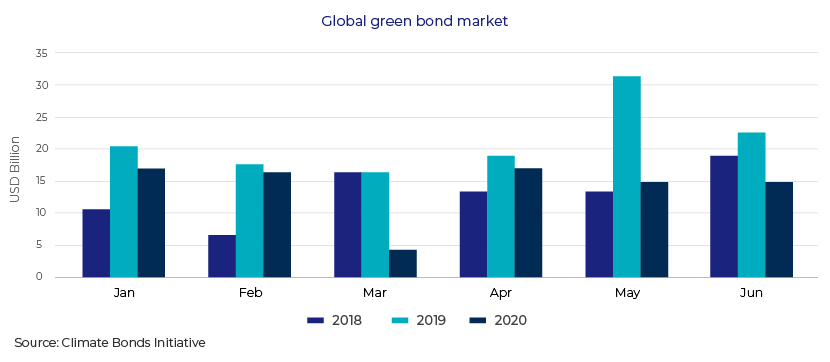

Despite the pandemic, data from the green bond market suggests that green financing has recovered since the setback in March and is here to stay.

Domestic and international factors are driving China’s ESG market

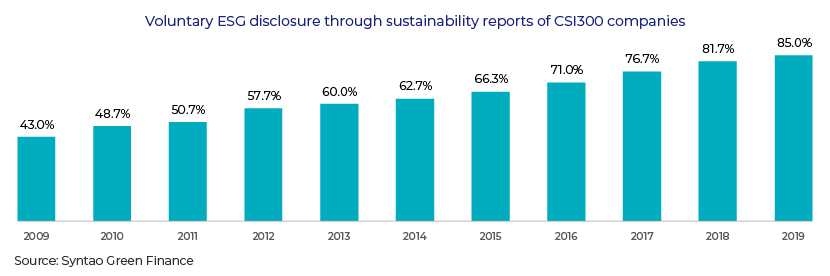

China has seen significant acceptance of environmental, social and governance (ESG) investing in recent years, driven mainly by demand from international investors and increasingly stringent regulations on company disclosure – particularly on environmental issues. ESG due diligence in China has until now been focused on governance factors, but environmental issues are becoming increasingly more significant. This seems logical given that governance risks are universal across companies and precede social and environmental risks, which may differ by sector and geography. On the equity side, the inclusion in 2018 of Chinese A shares in the MSCI and FTSE Russell indices has made companies propelled by investors with an ESG mandate aware of ESG issues. Accordingly, China’s listed companies are increasingly adopting ESG disclosure, as the following chart shows:

On the debt side, Chinese commercial banks have led growth of green loans to channel funds for projects to build a greener economy. The total outstanding balance of green credit of 21 major Chinese banks was RMB9.66tn (c.USD1.38tn) at the end of 2018. Meanwhile, the global green bond market has gained pace in the past five years, with China now the second-largest green bond market in the word. A total of USD31.3bn worth of green bonds (aligned with international definitions) was issued in China in 2019, according to data from the Climate Bonds Initiative, only behind the US, which issued USD51.3bn worth last year. China issued only USD2.32bn worth of green bonds after the initial setback in 1Q 2020, but the market recovered in April, with over USD5bn worth being issued by Chinese issuers.

Unlike in developed markets, ESG integration in China is mostly top-down, with the government and regulators strongly pushing for integration of ESG-related issues. Much of the groundwork was laid before President Xi Jinping made a commitment at the 2015 UN Climate Change Conference that China would reach its carbon emissions peak by 2030. China’s environmental protection authorities issued several policy documents from 2007 to 2015 that require disclosure of environmental information by key pollutant-discharging units.

-

The China Securities Regulatory Commission (CSRC) and the stock exchanges of Shanghai and Shenzhen have issued policies and guidelines over the years regulating standards, content and formats for environmental and social information disclosure of listed companies

-

In 2016, the People’s Bank of China (PBoC) and other ministries jointly issued Guidelines for Establishing the Green Financial System

-

In November 2018, the Asset Management Association of China released Guidelines for Green Investment (Trial) to guide and standardise the green investment activities of securities investment funds

Challenges remain for China’s ESG market

However, it would be wrong to say that ESG investing is a well-established practice in China’s financial market. A few key challenges remain to unlocking its full potential, including a limited understanding of ESG issues, a lack of unified standards to enable comparability across companies and, most importantly, limited research to convincingly demonstrate the advantage of ESG investing over traditional analysis. Many of the disclosure requirements remain voluntary in nature. International investors still see a gap between international and Chinese frameworks for classifying a project as green. However, regulators are taking steps to align these differences and develop a robust ESG framework to lower the barriers for international investors. For instance, in May this year, the PBoC excluded “clean” fossil fuels from the list of projects eligible for green financing, coming one step closer to international standards.

Conclusion

ESG investing – notwithstanding the short-term obstacles – should continue to gain momentum globally in the post-COVID-19 world. Certain societal changes are already visible. Acceptance of the change, in terms of working, meeting and studying from home by employing technology has promoted digitisation across sectors, leading to an efficient use of resources – a key message of the ESG movement. The loss of livelihoods and the lack of adequate healthcare infrastructure and community safety nets have revealed social issues in sharper detail than ever before. To manage their risks and price in externalities, investors will likely demand more transparency and disclosure from companies. Acuity Knowledge Partners has been assisting sell-side and buy-side research firms, corporates and investments banks with ESG research. Our team of bilingual analysts based in Beijing supports clients with ESG due diligence including ESG policies and frameworks, analytics on ESG indicators and themes, scoring, rating and benchmarking, report writing and customised research on ESG themes.

Note:

1) The chart considers only those issuances that are in line with international definitions of “green bonds”. It excludes USD24.2bn worth of labelled green bonds issued in China that were not in line with international standards

References:

1. Climate Bonds Initiative – https://www.climatebonds.net/resources/reports/2019-green-bond-market-summary

2. Syntao Green Finance – http://www.syntaogf.com/Uploads/files/China%20Sustainable%20Investment%20Review%202019.pdf

4. CFA Institute – https://www.cfainstitute.org/-/media/documents/survey/esg-integration-china.ashx

5. China Daily – http://www.chinadaily.com.cn/world/XiattendsParisclimateconference/2015-12/01/content_22597889.htm

7. https://en.wikipedia.org/wiki/Indian_Ocean_Tsunami_Warning_System

8. https://time.com/5797629/health-1918-flu-epidemic/

What's your view?

About the Author

Faisal has over 13 years experience in investment banking with domain expertise in sustainability. He manages multiple client teams across Corporate Finance / M&A, and Sustainable Finance at Acuity China. A significant aspect of his work involves managing client relationships, setting up new client teams, coaching and mentoring of team members, finalizing methodology documents and knowledge management of ESG content.

Faisal has hands-on experience in financial analysis & valuation and extensive knowledge of sustainability, climate risk, circular economy and ESG standards and frameworks.

He holds an MBA from ICFAI University and the Sustainability & Climate Risk Certification from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox