Published on May 3, 2018 by Dipender Thapa

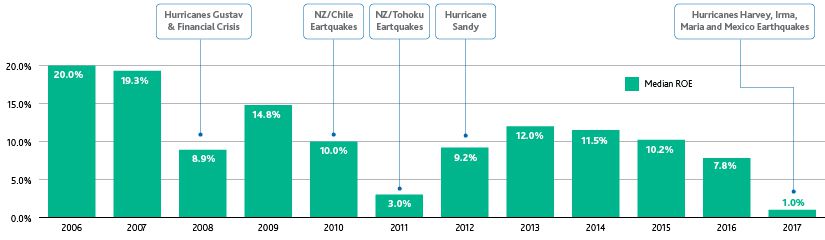

Hurricanes Harvey, Maria and Irma rocked the insurance industry in 2017, causing a combined economic loss of about USD220bn. Reinsurers’ profitability was the most significantly hit, reaching its lowest levels since 2005, as the following chart shows. The US reported over 50% of the losses.

Source: Moody's Investors Service

We believe that despite incurring substantial losses, the insurance industry with its USD600bn of capital is well positioned to face any new challenge. Alternative funding sources have boosted reinsurers’ capital bases and their capacity to underwrite.

Alternative capital is becoming popular as a secondary source of funding, strengthening reinsurers’ bargaining power versus conventional lenders’

Access to capital markets to raise funds in the form of collateralized reinsurance is the new alternative in the insurance industry. Since 2015, reinsurers have been moving away from banks to alternative capital providers to reduce their cost of funding. Their bargaining power against conventional lenders like banks has increased in recent years as alternative capital sources have become popular. Such capital providers, like investors in insurance-linked securities (ILS), have boosted reinsurers’ capital bases, helping them to replenish capital eroded in 2017.

However, a setback for reinsurers is the likelihood that premium pricing will remain modest going forward due to more underwriting capacity in the market supported by alternative capital sources.

Collateralized insurance helps the UK and Lloyd’s to diversify insurer protection

The growing use of alternative capital is helping reinsurers significantly diversify the protection they offer to insurers. Collateralized arrangements have presented new protection options to reinsurers in the UK and to Lloyd’s, the world's leading insurance market, in the past three years. Increased risk sharing by collateralized insurance has sizably reduced reinsurers’ concentration of risk. Collateralized coverage would absorb c. 24% of losses in UK insurance, according to Prudential Regulation Authority (PRA) estimates, providing notable financial support to this market.

Increased dependence on retrocession should help maintain underwriting capacity

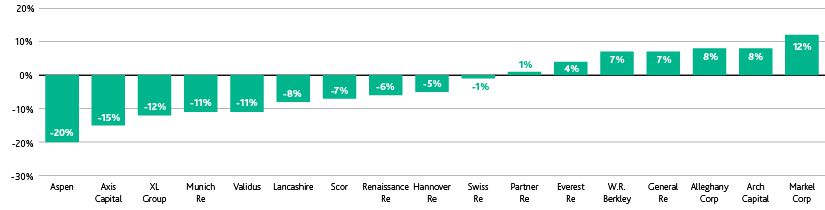

Reinsurers are increasingly relying on retrocession to reduce their excess capital. (Retrocession refers to the practice of one reinsurance company providing services to another by insuring the other’s activities. This is done by accepting business that the other company had agreed to underwrite.) Following this strategy, the reinsurer’s underwriting capacity is maintained and reduces risk when it needs to raise capital. The following chart shows how most reinsurers reduced their equity bases in 2017 (partly due to losses) and increased their focus on retrocession.

Source: Annual reports,Moody's Investors Service

Acuity Knowledge Partnerscommercial lending teams strategically partner with some of the world’s largest banks, to manage their corporate loan books. Our FIG sector experts have in-depth understanding of the latest trends and opportunities in and challenges facing the industry. Our credit analysis reports provide prudent views to help origination and risk teams to manage banks’ loan books and risk-weighted assets.

Sources:

Moody’s Credit ratings -https://www.moodys.com/

https://www.insurancejournal.com/news/international/2018/04/18/486728.htm

https://www.insurancejournal.com/news/national/2018/01/11/476937.htm

https://www.insurancejournal.com/news/national/2018/01/04/476093.htm

Tags:

What's your view?

About the Author

Dipender Thapa has 15 years of experience in investment research and commercial lending. In his 10+ years at Acuity Knowledge Partners, he has managed several credit research and commercial lending teams. He is an expert in the financial institutions group (FIG) sector – covering banks, insurance companies, funds, and sovereigns – and has conducted analyst training sessions at Acuity Knowledge Partners’ Bangalore and Colombo delivery centers.

He has set up three new commercial lending accounts in the past six years, with experience in diverse sectors such as Leverage Lending, Social Housing, FIG, Aviation, and Fund finance. He currently..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox