Published on January 27, 2020 by Arjun Prasad

-

The US and European leveraged lending (LL) and collateralised loan obligations (CLO) markets have doubled in size over the past decade

-

Exposure of non-bank entities, such as asset managers (AMs), to LL and CLOs stood at 57% and 72%, respectively, as of 2018

-

AMs should remain vigilant about their LL and CLO exposure, as risks in these segments are increasing

-

Acuity Knowledge Partners can support managers by maintaining checks on exposures through constituent analysis, issuer review, detailed capital structure, covenant reviews and other services

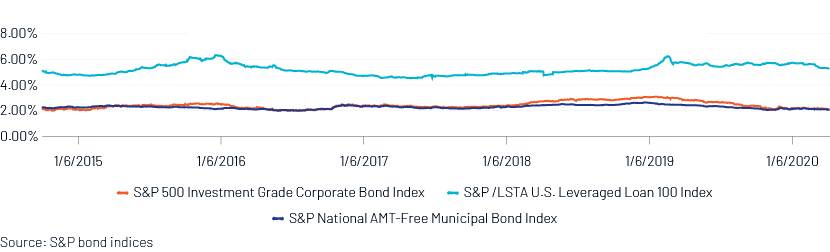

The hunt for yield has supported market expansion

The US LL market is estimated to have expanded by c.2.5x to USD1.2tn by December 2019 and the European LL market by 1.5x to EUR200bn by September 2019 since 2010. The US CLO market has doubled to USD620bn over the past decade, while the European CLO market has declined by 19% to EUR196bn.

Growth over the past decade was driven by historically low interest rates and ample liquidity in the markets. Lower yields on traditional assets resulted in AMs shifting their focus towards alternative investments such as LLs and CLOs that offered more attractive yields.

Figure1:Attractive returns on Leveraged Loans attracted Asset Managers

Slowing economic cycle: Cracks appearing in the LL and CLO markets

-

Weak underwriting standards: LL markets have witnessed a rise in covenant-lite (cov-lite) loans (discussed in an earlier blog) and significant add-backs to EBITDA

-

Cov-lite loans have shifted execution risk to lenders, with clauses relating to restricted payments, negative pledges and restrictions on additional debt issuance removed for the issuer

-

The sharp increase in advantages for issuers, despite the EBITDA add-backs, has made some of the issuers more risky. They have missed leverage targets by c.200bps over the past three years

-

-

Changing capital structure: LLs have replaced subordinated loans in the capital structure (recently, the share of LLs had dropped to even 0% of the capital structure in some cases from 25% as observed historically). The lower cushion available, along with the cov-lite nature of the loans, has resulted in a c.230bps decline in LL recovery rates.

-

Credit rating arbitrage: CLOs transfer the rating of sub-investment grade collateral to investment grade when packaged together. 85% of “AAA” rated CLOs have c.70% of assets from the “B” rated pool, as per the Office of Financial Research.

-

Default risk for lower tranches: Downgrades in “B” rated assets would compel CLO managers to liquidate “CCC” rated securities, resulting in significant losses for junior and equity tranches (mainly held by hedge funds).

-

Concentration risk in CLOs arises from the following:

-

Issuers: In the US, 90% of CLOs have exposure to at least one of the top 50 borrowers, while in Europe, c.80% of CLOs have exposure to at least one of the top five borrowers

-

Sectors such as consumer goods, high-tech, healthcare, and media and entertainment constitute c.45% of US-based issuers of “B” rated securities

-

Acuity Knowledge Partners’ unique experience

As the economic cycle has turned, US corporate default rates have increased (1.5% in November 2019 vs 0.8% in January 2019), while the cov-lite nature of the loans threatens to introduce lower recovery rates for investors. Consequently, risks related to capital and liquidity shortfall have increased. As such, it has become imperative that asset managers actively track their exposure to the LL and CLO space. Acuity Knowledge Partners has been supporting some of the largest CLO managers globally through our customised leveraged lending solutions.

Sources:

1. Leveraged loan market size doubles in ten years, private credit explodes: Reuters (Dec’19)

2. OFR FRAC Working Group: Leveraged Lending & CLOs (Jul’19)

3. Financial Stability Board: Vulnerabilities associated with leveraged loans and CLOs (Dec’19)

What's your view?

About the Author

Arjun Prasad has over 5 years of experience in fixed income research. He has experience in supporting European and US based CLO managers by identifying suitable constituents through screening and analyzing credit quality of high yield European and US issuers. His analysis has assisted his clients to successfully roll off multiple warehouses. He holds MBA (Finance) and Bachelor of Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox