Published on December 7, 2020 by Sharmila Thambawita

The relevance of the current international taxation system, developed over a century ago with a “brick-and-mortar” economic environment in mind, is being questioned by the international community as the world economy transforms digitally. Multinational corporates (MNCs) being taxed based on the region where production occurs, as opposed to where customers are located, has become the focus of the debate.

Such concerns led to the creation of the Organization for Economic Co-Operation and Development’s (OECD’s)/the G20’s Inclusive Framework on Base Erosion and Profit Sharing (BEPS). The framework brings together 137 countries and jurisdictions for multilateral negotiations to determine a long-term solution to the tax challenges arising from the digitalisation of the world economy. An agreement is expected to be reached by mid-2021.

The framework is split into two pillars:

Pillar 1

This pillar will reallocate taxing rights based on an entity’s business activities that do not have a physical presence. Furthermore, issues such as the basis for tax and in which localities taxes should be paid, and how much profit could/should be taxed based on the location of the customer (digital or otherwise) will be addressed.

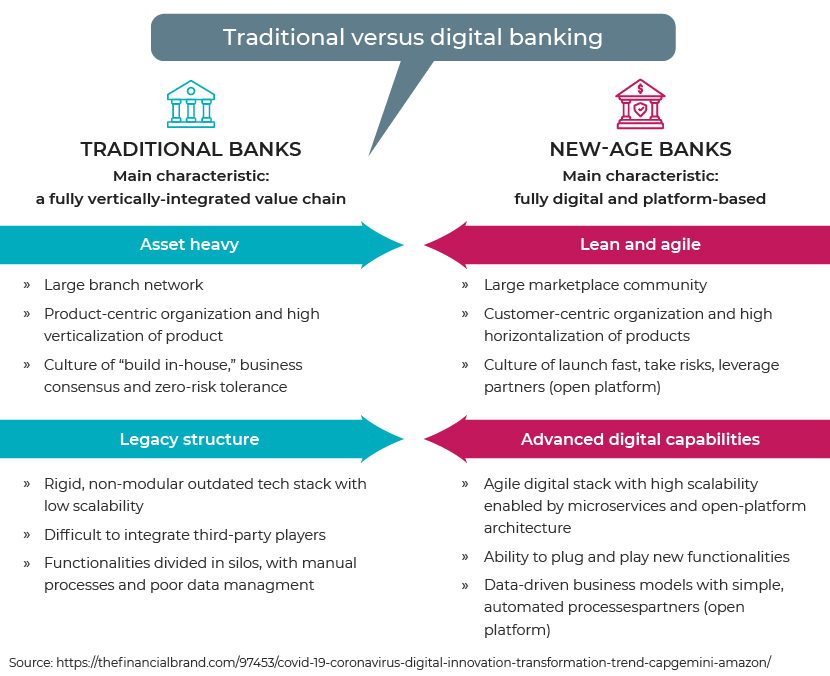

Banks have been transitioning from a traditional branch network model to a more digitalised one with the use of apps and websites in recent years. The corporate banking vertical of the global digital banking market is forecast to grow at a CAGR of more than 8% over 2020-26, according to the Global Market Insights website, and global demand for digital banking is forecast to grow at a CAGR of 6% over the period to reach a market value of over USD12tn.

We expect this significant shift in demand for digital banking to expedite the imposition of a digital services tax (DST) for banks. Consequently, pillar 1 of the OECD/G20 framework will ensure that sufficient taxable profit is allocated to a particular market jurisdiction, regardless of the physical presence of the financial institution. Furthermore, as per the OECD’s 2010 report on the Attribution of Profits to Permanent Establishments, the lending and borrowing (customer deposits) activities of a bank and the supporting ancillary functions are proposed to be taxed using the tax rate of the jurisdiction in which the income is earned/incurred, and not the jurisdiction where the income-earning activity/asset was generated.

Pillar 2

A global anti-base erosion mechanism will be formulated under this pillar to ensure that MNCs cannot transfer profits to low-/no-tax jurisdictions by using loopholes in the tax system. Furthermore, a guaranteed minimum tax will be imposed on MNCs, and a fair taxation system will be implemented for both traditional and digital companies.

The pillar aims to curb possible regulatory arbitrage carried out by banks that use securitisation techniques to shift expensive regulatory capital requirements to balance sheets in more lucrative jurisdictions, and the use of credit derivatives and hedge funding to take advantage of beneficial regulatory capital requirement regimes in different jurisdictions. Moreover, the new taxation system intends to monitor the extent to which banks issue short-term “cheaper” loans for long-term lending purposes in order to capitalise on the interest rate yield curve, as well as the extent of the use of “free” capital (such as retained earnings and funds from equity issuance) for loan issuance. These activities can have a significant impact on a bank’s profitability, as debt servicing is tax-deductible.

Current progress

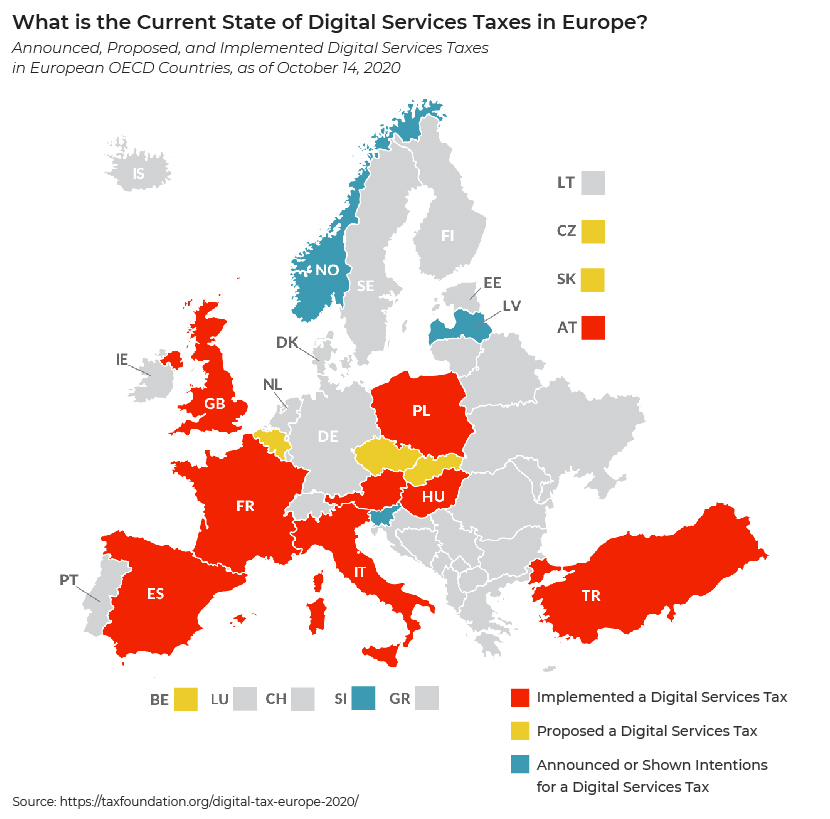

Despite ongoing negotiations, several countries have proceeded with independent measures to tax their respective digital economies. Approximately half of all European OECD countries have either proposed or implemented a DST. Although financial institutions are currently exempt from DSTs, the OECD stated in February 2019 that it does not foresee exemptions from its framework for any sector.

The COVID-19 impact on banks and the knock-on effect on DSTs

The lockdowns and social distancing as a result of the pandemic have rendered physical banking somewhat obsolete. The substantial shift in demand for digital banking services and other ancillary banking services such as telephone banking and call-centre services is expected continue into the foreseeable future, even after the pandemic, as it is forecast to create a permanent positive shift in consumer preference towards digital banking.

The pandemic has had a significant adverse impact on global equity and debt capital flows, with the scale and speed of outflows from emerging-market economies (EMEs) being four times larger than during the 2008 financial crisis. Demand for advanced-economy bond funds has led to positive inflows since end-April 2020. These developments make DSTs even more relevant for financial institutions, as it is evident that digitalisation of banking services is here to stay.

How Acuity Knowledge Partners can help

Our Data Sciences service offering can acquire, prepare, and standardise macroeconomic data for DST analysis purposes; provide data analysis in terms of data mining, deep learning, and stochastic/statistical modelling; and produce bespoke presentations of DST data in formats such as dashboards, data lakes and reports. Our AML Analytics vertical can produce scenarios/models for different DST thresholds, while our Leveraged Lending department can provide detailed financial analysis, sensitivity analysis, and financial model updates to view the impact of various DST rates on an entity’s operations.

Sources:

http://www.oecd.org/tax/beps/beps-actions/action1/

https://taxfoundation.org/digital-tax-europe-2020/

http://www.oecd.org/tax/transfer-pricing/45689524.pdf

http://www.oecd.org/coronavirus/policy-responses/covid-19-and-global-capital-flows-2dc69002/

https://www.gminsights.com/industry-analysis/digital-banking-market

What's your view?

About the Author

Sharmila Thambawita has over 10 years of work experience including 3 years in Commercial Lending. Currently she is a Delivery Lead, overlooking a team of analysts responsible for the Structured Export Finance sector of a leading European based bank. Prior to this, she has served diverse client engagements in both the equity and fixed income verticals. Sharmila is an Associate member of the Chartered Institute of Management Accountants (UK).

Comments

07-Dec-2020 03:32:00 am

Excellent analysis and the content is very useful.

Like the way we think?

Next time we post something new, we'll send it to your inbox