Published on May 28, 2020 by Pooja Golait

In the wake of “the Great Lockdown”, the global economy is projected to contract by a sharp 3.0% in 2020* (US: -5.9%, the Euro area: -7.5%), much worse than during the 2008-09 Global Financial Crisis (GFC). Governments and central banks have introduced extraordinary measures, ranging from quantitative easing (QE) to payment moratoriums and government guarantees on loans. There is no doubt that such responses are unprecedented and may keep the system’s non-performing loans (NPLs) in check. However, it is still widely expected that US and European banks may see a significant increase in NPLs and loan loss charges (LLCs) in 2020 due to rising defaults in stressed exposures

Tsunami of new defaults to hit banks, along with higher provisioning

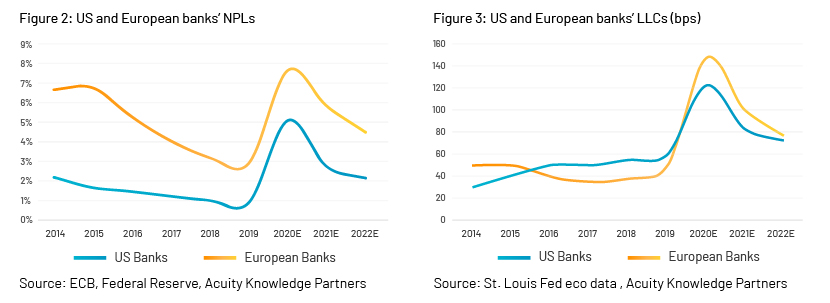

Most US and European banks enjoyed a benign credit cycle from 2014 to 2019, with declining NPLs and LLCs on the back of improving global macros and domestic economies. However, this cycle is now past, and they are looking at a significant build-up of NPLs in the medium term due to COVID-19-related economic stress, along with higher provisioning requirements, due to fundamental changes in the scenario.

US and European banks’ NPLs touched highs of 5.6% and 8.2% of loans, respectively, during the 2008-09 financial crisis. LLCs were as high as 320bps for US banks and 180bps for European banks.

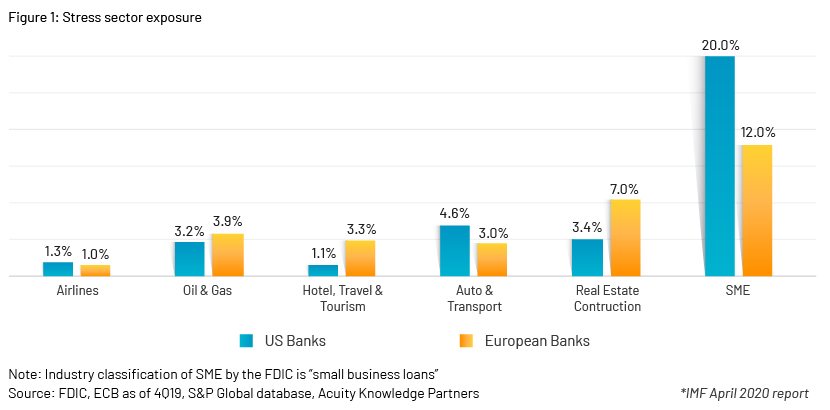

Regulators have tried to ease the pain on banks’ balance sheets by tweaking NPL recognition rules, but this is just a drop in the large bucket of new defaults. Government guarantees on new loans are a relief, but portfolios continue to bleed as exposures to certain sectors (Figure 1) face solvency issues.

The stress sectors cumulatively represent almost 37% of loans for US banks and about 28% of loans for European banks. In addition, these sectors represent a large part of the private-sector employee base. Business failures in these sectors are likely to affect consumers as well.

Risk is manageable with prompt regulatory responses and built-in capital and liquidity buffers

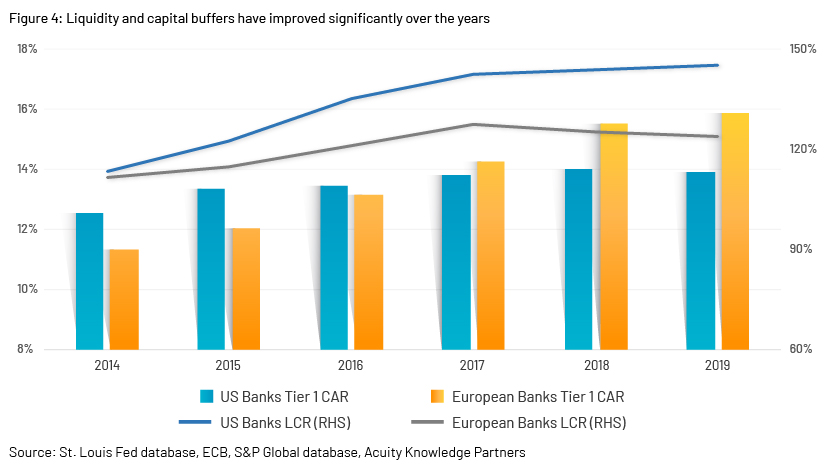

Despite a somewhat bleak outlook, we believe US and European banks are in a much better position today in terms of liquidity and capital buffers to tackle the rise in NPLs and LLCs. To put things in prospective, US banks’ tier 1 capital adequacy ratios (CARs) have improved by 400bps since the GFC and European banks’ by a staggering 600bps. The dividend pay-out and share buybacks cancellations proposed by the regulators for 2019 and 2020 could add about USD260bn to US and European banks’ war chests. The regulators’ prompt actions are also likely to cap the rise of NPLs.

CAR – Capital adequacy ratio, LCR – Liquidity coverage ratio

Conclusion – Adapting to the ‘new normal’

Banks’ business models are sensitive to economic and credit cycles. In the wake of historic economic losses, they are bound to be affected. Like other businesses, banks are also trying to modify their risk management strategies to adapt to this “new normal” to minimise actual losses. Although they are well prepared, with much stronger balance sheets and prudent capital and liquidity buffers, we acknowledge that the human impact of this crisis and its impact on the real economy are still evolving.

At Acuity Knowledge Partners, we have expertise in developing risk-weighted scenario-based credit risk models for our global clients. Our in-depth sector knowledge enables us to help our clients and investors understand credit cycles and their impact on banks and diversified financial service providers.

Sources:

https://www.bankingsupervision.europa.eu/banking/statistics/html/index.en.html

https://www.fdic.gov/bank/statistical/

https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

https://ihsmarkit.com/research-analysis/banks-drive-european-dividend-growth-in-2020.html

What's your view?

About the Author

Pooja Golait started her career with Acuity Knowledge Partners in 2018. She currently works with P&T Team. She holds a Post Graduate in Business Management with a specialization in Finance from Christ University, Bangalore. She also holds a bachelor’s degree in Engineering (Computer Science) from NMIMS University, Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox