Published on March 22, 2021 by Hasindu Dissanayake

The importance of micro, small and medium enterprises (MSMEs) in an economy

Over 90% of businesses and 50% of employment worldwide fall into the MSME category – a significant driver of economic growth. The segment’s vulnerability to economic downturns prompted policymakers to introduce special loan schemes to protect it amid the COVID-19 pandemic.

The financing gap faced by MSMEs

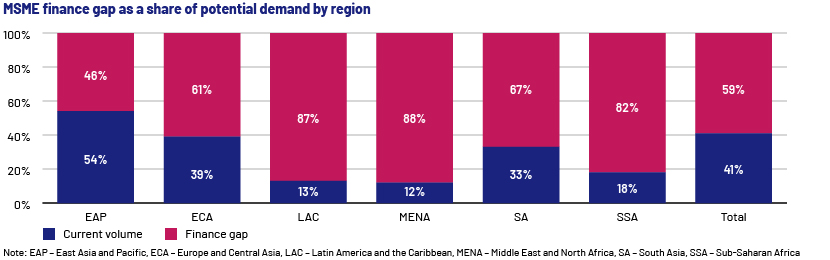

Unlike large corporates, MSMEs often face challenges when trying to secure bank loans, causing them to rely on personal equity. Forty percent of formal MSMEs have unmet financing needs, according to the International Finance Corporation (IFC). The finance gap is valued at USD5.2tn, making up 59% of the demand.

MSME lending – a largely untapped opportunity for banks

The MSME segment is a lucrative lending opportunity for banks in the developing world, with its approximately 162m formal MSMEs, according to the World Bank. In developed countries such as the US, 99% of businesses are small businesses, according to the Small Business Administration Office of Advocacy.

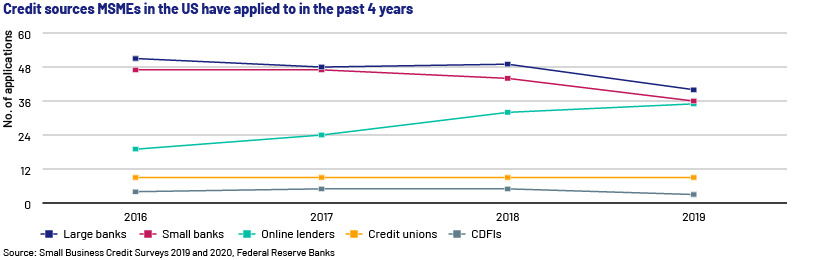

MSMEs have historically relied heavily on banks or venture capitalists for funding. However, in the recent past, banks have been facing competition from innovative financial solutions providers such as fintech companies, online peer-to-peer lending and crowd funding platforms. These alternatives have disrupted the market and challenged the conventional lending approach. As a result, they have attracted potential borrowers and pressured sector incumbents.

However, banks have a competitive advantage over these alternatives due to factors such as their access to low-cost funding and legacy systems to provide better financial solutions. We believe banks should capitalise on this advantage in order to eliminate the risk of losing a vital customer segment.

Bridging the lending gap of MSMEs – the way forward

1. Lack of a strong asset base for collateral purposes

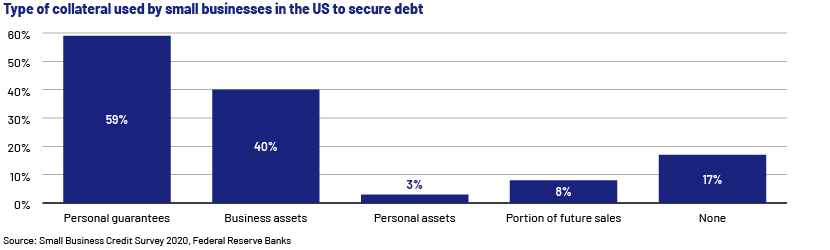

The majority of MSMEs do not have solid asset bases and operate with limited resources. As a result, they use secondary collateral such as guarantees or inventories that are less liquid and attractive than primary collateral such as property mortgages or machinery. Such collateral can pose challenges to banks during the liquidation process. Therefore, banks are more selective and cautious when determining collateral acceptable for MSME lending.

Shifting their focus towards lending against secondary collateral such as personal guarantees, stocks and government guarantees would help banks reach this relatively untapped lending segment. Consequently, it would increase the likelihood of MSMEs securing bank financing.

As a policy measure to recover from the economic impact of the pandemic, most countries have proposed issuing government guarantees to cover part of the loans obtained by MSMEs to encourage lending by banks. Such schemes enable banks to transfer part of their credit risk to the government and also present an opportunity to increase MSME market share at a lower risk.

2. High risk of default due to increased sensitivity

The size and nature of their business, combined with capital inadequacy, have made MSMEs more sensitive to adverse macroeconomic conditions. Furthermore, lower business volumes during a recession could lead to late payments and defaults on MSME loans, ultimately resulting in higher non-performing loans in the business segment.

MSMEs in Europe are more sensitive to the adverse effects of the pandemic than large companies and may find it difficult to recover, according to the European Central Bank (ECB). The ECB also expects a sharp rise in non-performing loans in 2021, posing a significant challenge to the banking sector.

To overcome this challenge, a bank should establish an integrated robust covenant monitoring system that would improve the efficiency of loan-monitoring processes. Using a centralised system to collate covenants and track credit agreement requirements that would simultaneously generate early warning signals and alert the bank of a breach could streamline the monitoring process significantly. This would minimise the burden on portfolio managers and reduce the risk of default as well.

3. Rejection of loans due to low credibility and cumbersome approval procedures

Banks’ traditional risk assessment models depend heavily on borrowers’ financial statements and credit histories. Since most MSMEs are relatively new, they do not have credit histories and are unable to provide historical financial data. Therefore, banks find it difficult to analyse the credit risk associated with the entity, resulting in the rejection of loan applications. Furthermore, the risks mentioned above lengthen banks’ loan approval processes for MSMEs. Alternatively, unconventional providers of finance such as fintechs have established automated underwriting and risk assessment systems that enable faster borrower-assessment services.

Digitalisation of the loan approval procedure would help banks change their approach to MSME lending. Automating the loan underwriting, risk assessment and pricing functions would help banks expedite the credit approval process and provide faster end-to-end solutions to MSMEs. The world’s leading fintech companies, such as Ant Financial and Avant, have successfully adopted this methodology.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners currently supports global investment and commercial banks with portfolio and covenant monitoring. We can also provide support in analysing credit risks associated with particular business segments through market research and financial forecasting. We offer financial spreading services with projections and comprehensive cash flow models with detailed analysis for current and future risk assessments. Our know-your-customer (KYC) services can help with processes such as due diligence monitoring, transaction tracking, sanctions screening and customer risk rating. We also assist banks with digitalising their lending processes.

Sources:

https://www.worldbank.org/en/topic/smefinance

https://www.fedsmallbusiness.org/survey/2020/report-on-employer-firms

https://www.fedsmallbusiness.org/survey/2019/report-on-employer-firms

https://www.moodysanalytics.com/articles/2018/redefining-loan-monitoring

https://www.europarl.europa.eu/RegData/etudes/IDAN/2021/659634/IPOL_IDA(2021)659634_EN.pdf

What's your view?

About the Author

Hasindu has over 7 years of work experience including 3 years in Commercial Lending. Currently he is working as a Senior Associate, carrying out loan covenant monitoring and validations, financial spreading and performing risk raters for the Structured Export Finance sector of a leading European bank. Prior to joining Acuity Knowledge Partners, he was attached to the Corporate Banking – Foreign Currency Lending division of a leading private bank in Sri Lanka. Hasindu holds a Degree in Business Management from Cardiff Metropolitan University – UK and he is an Associate Member of the Institute of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox