Published on September 22, 2020 by Sidharth Suresh Nair

Asia is home to over half the world’s population, with some of the fastest-growing economies and a rapidly expanding working class. Credit Suisse expects total household wealth in Asia-Pacific to surpass North America’s in 2023. Rising standards of living and longer life expectancy will likely soon become key characteristics of the Asian demographic.

Asia to lead growth in insurance products

As standards of living rise and health concerns due to the pandemic heighten, we expect demand for insurance products to increase. Penetration rates for Asia-Pacific stood at 3.8% for life insurance and 2.1% for non-life insurance in 2018, considerably lower than in the UK and the US that reported rates of over 10%. Insurance company Swiss Re estimates that by 2029, 42% of gross insurance premiums would originate from Asia-Pacific, with China accounting for 20% of this. Asian consumers are increasingly looking at insurance not just as a protection but also as an investment option.

Consumer preference shifting towards digital channels

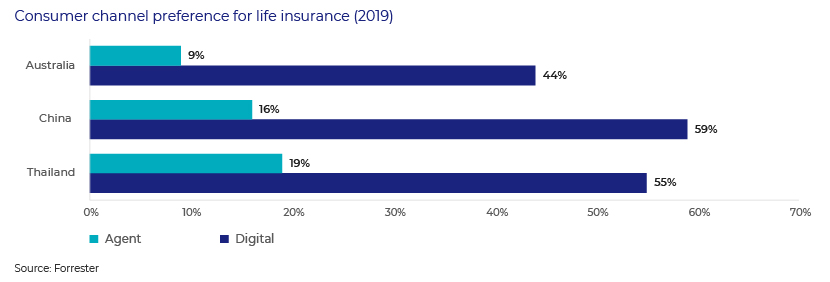

While we see an increase in insurance adoption, customer expectations are shifting from traditional broker- or agent-driven models to online and mobile channels.

The number of internet users in Asia-Pacific reached 2.3bn by end-2019, although the internet penetration rate of 55% in the region is still lower than the global average of 60%. Most Asia-Pacific consumers (73%) feel that a mobile device is all they need to perform any financial task.

Consumers also increasingly prefer digital insurance ecosystems due to the prevalence of smartphones that enable them to perform a number of tasks, including funding home-based care (in addition to hospital care), consulting virtual doctors, checking symptoms and following digital wellbeing programmes. The largest Asian platforms, such as Alibaba and Tencent, now offer insurance products along with complementary products.

This shift presents interesting opportunities for domestic and international fintech and insurtech companies looking to capitalise on the Asia-Pacific market.

Regulatory landscape and market dynamics favourable for new players

Restrictions on foreign ownership in the insurance sector are being eased, with markets such as China and India raising their caps on foreign ownership and other markets such as Indonesia and Malaysia likely to follow suit. The Singapore government launched a “fintech regulatory sandbox” that enables fintech players to experiment with new products and services in a live environment while enjoying legal and regulatory relaxations during their time in the “sandbox”.

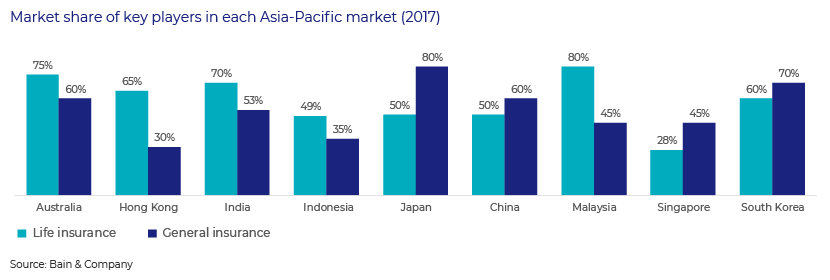

The insurance markets of most Asia-Pacific countries are dominated by the top players who hold up to 80% of the market share in countries such as Japan. The leading players include China Life and Ping An in China, LIC and HDFC Life in India, AIA across Asia-Pacific, Japan Post and Nippon Life in Japan, Samsung Life in South Korea, Great Eastern in Singapore and Malaysia, NTUC Income in Singapore, AIG in Thailand, Cathay Life in Taiwan, Bao Viet in Vietnam, and IAG and Suncorp in Australia.

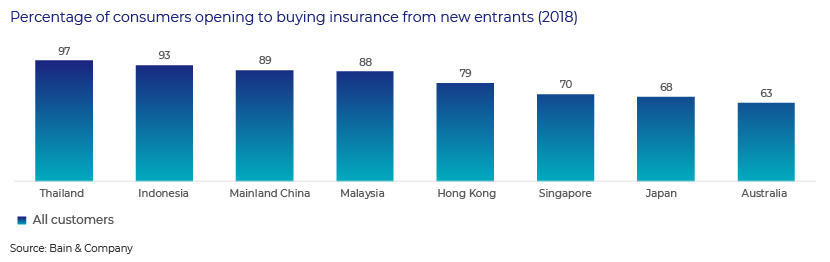

Although the established incumbents are increasingly adopting technology and digital channels in their operations, the markets present opportunities for new entrants, particularly insurtech players, to gain customers. Young and digitally active users are open to doing business with new entrants.

Technology companies in Asia-Pacific now have access to ample venture capital (VC) and private equity (PE) funding that was previously directed at startups in Western markets.

Growing VC interest

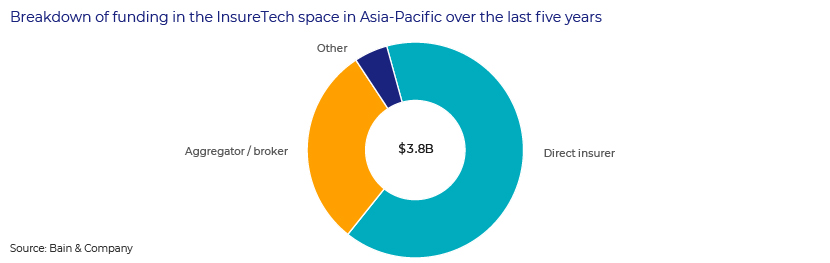

VC investment in Asia-Pacific insurtechs was USD3.8bn over the past five years. Some key beneficiaries during this period were ZhongAn, China’s insurtech pioneer, that raised USD1.5bn in its IPO in 2017 and Indian marketplace PolicyBazaar that raised c.USD365m also in 2017. Other key players include Singapore-based SingLife and CXA Group, and Malaysia-based PolicyStreet.

Direct insurers and digital aggregators/brokers were the major beneficiaries of the funding. The other areas, primarily B2B and serving the existing insurance players, are relatively nascent.

If you cannot beat them, join them

In markets where established players have championed digital adoption, insurtechs can collaborate to develop value-added solutions across the insurance value chain and create an ecosystem for greater consumer participation. Ride-hailing behemoth Grab has collaborated with providers such as ZhongAn and Chubb to offer insurance products on its platform. In China, Tencent’s WeChat ecosystem also includes WeSure, which allows users to buy insurance products within the ecosystem.

Areas such artificial intelligence (AI), the internet of things (IoT) and blockchain for underwriting risk, predicting losses, claims management and data management present new opportunities. For example, Thailand-based AppMan offers a solution to insurers to improve the insurance sales experience.

Traditional insurance companies are also making use of their corporate VC arms to invest in emerging technologies. US-based MassMutual Ventures, the VC arm of Massachusetts Mutual Life Insurance Company, launched its second Southeast Asian fund worth USD100m recently to invest in insurtech and other sectors.

IDC Insights predicts that by end-2020, 40% of tier 1 insurers in Asia-Pacific will work with at least three insurtechs; we could, therefore, see many new players emerging.

The COVID-19 boost

The pandemic that has had a profound impact on the global economy has been unsurprisingly tough for insurance companies as well. Liability claims and dwindling profitability have led to several companies altering or pulling out of their contract terms and refusing to cover certain aspects of claims.

Consumer demand for life insurance has increased owing to a shift in consumer behaviour towards a more cautious approach and the availability of options to avail themselves of a policy without having to leave the safety of their homes.

Global investments in insurtech surged 71% y/y in 2Q 2020 to c.USD1.6bn following a slowdown early in 2020, according to Willis Towers Watson. Insurance companies that have failed to automate their processes would suffer significantly, benefiting insurtech companies.

Conclusion

Insurance has evolved from a hard-to-understand financial product to a technology product available at the click of a button. Insurance processes are undergoing sweeping changes with advancements in AI and machine learning helping companies to reduce costs and improve customer service.

The Asia-Pacific market, with its large young population, growing digital adoption, rising disposable income and advancements in technology, is a strategic sweet spot for global insurance companies and financial investors.

Insurtech firms in Asia are looking to evolve from a simple aggregation model or price comparison portals to offer personalised, on-demand and usage-based insurance services delivered to the customer’s home, and offer cutting-edge technologies for other insurance firms.

Sources:

https://www.statista.com/statistics/265153/number-of-internet-users-in-the-asia-pacific-region/

https://www.statista.com/statistics/265156/internet-penetration-rate-in-asia/

https://www.mas.gov.sg/development/fintech/regulatory-sandbox

https://stats.oecd.org/Index.aspx?QueryId=25444

What's your view?

About the Author

Sidharth has over 8 years of experience in investment banking and advisory services. He joined Acuity Knowledge Partners in Jul’18 and currently leads a team catering to a boutique advisory firm in the European technology sector. He has previously worked with HSBC Investment Banking in multiple coverage and product teams across geographies, and was a key member of several landmark M&A and IPO transactions. Sidharth holds an MBA in Finance from Symbiosis University, Pune and a Bachelor of Technology degree in Computer Science & Engineering from NIT Calicut.

Like the way we think?

Next time we post something new, we'll send it to your inbox