Published on January 16, 2018 by

Global banking is witnessing events and undergoing rapid transformation that are redefining its strategic landscape. These have largely been triggered by the global financial crisis, with regulatory controls forcing banks (mainly in the US and Europe) to adopt new business strategies, and the advent of financial technology (fintech).

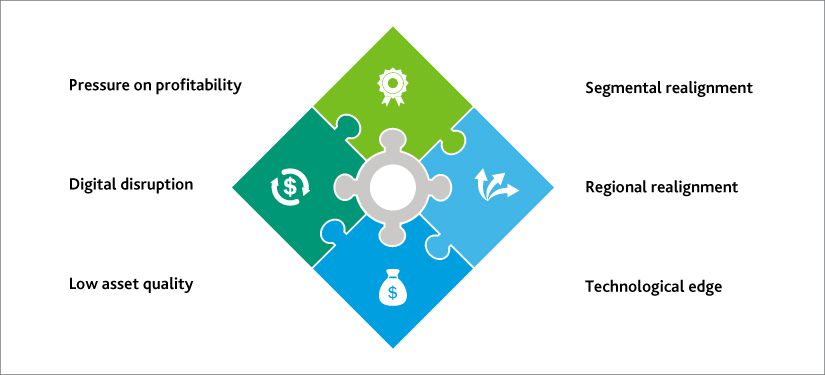

I see the following trends playing out in the global banking universe:

-

Pressure on profitability: Rising regulatory, compliance and capital costs have put substantial pressure on banks’ profitability, with the financial crisis of 2008-09 stimulating a wave of banking reforms. Since the crisis, 20 of the world's biggest banks have paid more than USD200 billion in fines and compensation. All major banks’ cost-to-income ratios have increased, with costs of managing correspondent banking relationships having increased five times.

-

Digital disruption: The advent of fintech and the entry of large technology companies into the banking industry have disrupted the traditional banking business model. In addition to niche fintech platforms, internet giant Alibaba in China and messaging giant Kakao in South Korea have entered into sub-segments such as payments, challenging global bank operations.

-

Low asset quality: The asset quality of banks, particularly those operating in emerging markets and the EU, has deteriorated sharply. Greece reported a non-performing asset (NPA) ratio of 36.4% in 2017, the highest in the world, followed by Italy (16.4%), Portugal (15.5%), Ireland (11.9%), India (9.9%) and Russia (9.7%).

Most large banks have adopted a broad strategy to achieve profitability targets, deciding to compete at the middle of the banking activity spectrum. They are carefully differentiating products and customer segments in selected markets, combining scale and scope.

Strategic realignment initiatives that such banks have undertaken in an evolving global market include the following:

-

Segmental realignment: Increasing regulatory and cost pressures are prompting banks to realign and rationalize their businesses. For example, Citibank and HSBC have exited consumer banking in Brazil. Some, such as Citigroup, have reinvented their core identities; Citigroup now describes itself as “a technology company with a banking license”.

-

Regional realignment: Rising regulatory and compliance costs and low profitability have led to US and European banks withdrawing operations in some geographies. Global banks divested more than USD2 trillion worth of assets from January 2007 to December 2016, more than half of which was divested by European banks. On the other hand, Canadian and Chinese banks expanded their global footprint. Canadian banks now have half of their assets offshore, up from 38% a decade ago, and Chinese banks now have more than USD1 trillion worth of foreign assets.

-

Technological edge: Rising competition from fintechs and the entry of large technology firms into the banking industry have led to rapid digitization, targeting a unique customer experience at a lower cost. Large banks are therefore investing in technology and automation, inorganically building capability through acquiring specialized digital platforms and reinventing their legacy technology infrastructure to gain a competitive edge.

For example, as part of its global reorganization exercise aimed at achieving profitability through realignment, London-headquartered Standard Chartered Bank recently consolidated its regional businesses to four businesses from eight.

With most global banks adopting similar strategies, such initiatives are likely to gather momentum until 2020.

Acuity Knowledge Partners, through its Investment Banking Strategy practice, is partnering with global banks to successfully achieve this strategic realignment by leveraging our research and analysis services pertaining to market entry, due diligence, opportunity assessment, exit strategy, competition assessment, industry landscaping and market mapping, among others.

Sources: Bain, McKinsey

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox