Published on July 2, 2019 by Chayanika Perera

Imagine eating a meatless steak, or printing your own five star meal at home! Or how about scrapping all that and just drinking your entire days’ worth of meals in one drink? What would have sounded like something straight out of a sci-fi movie a few years ago, are only a few of the latest mind-blowing transformations taking place in Silicon Valley today.

The food industry has been lagging in terms of technological evolvement compared to many others and is now rapidly playing catch-up. But why the sudden facelift? Because the world is waking up to an imminent global food crisis that is accelerated by supply shortages and fast diverging living standards, and these technological developments help the industry build constructive and sustainable solutions to address such issues. The FAO estimates 820 million people (c. 11% of the global population) suffered from chronic undernourishment in 2017, while in contrast, 672 million suffered from obesity and a further 1.3 billion were overweight. And as arable land continues to decline every year due to climate changes and urbanization, growing food to feed an estimated10 billion global population by 2050 is giving birth to some serious supply challenges. Moreover, agriculture is also one of the biggest polluters in the world. From a demand perspective, the call for environmentally-friendly sourcing, nutritious ingredients and product transparency are also driving significant disruption in the industry, particularly through startups. Let’s look at a few prominent catalysts that are taking a chunky bite off the current conventional food market in this competitive landscape. Below are the top 5 disruptive trends in Food Tech:

1. Meat alternatives

Plant-based meat substitutes and lab-grown meat has been experiencing phenomenal growth as of late as consumers increasingly shift away from meat due to health, humanitarian and environmental reasons. A study conducted by market research firm Nielsen showed that growth in plant-based meat in the US accelerated from 6% in 2017 to 24% in 2018, while demand for animal meats grew only 2% in 2018.

Beyond Meat and Impossible Foods are two companies that are thriving in the plant-based meat space. Beyond Meat, which is backed by high profile investors such as the Microsoft founder Bill Gates and actor-turned-environmentalist Leonardo Di Caprio, recently recorded the US’s best IPO since 2008, as shares soared 163% on first day of trading after debuting at $25 on 1 May 2019. It is also interesting that the US’s largest meat processor, Tyson Foods, owned a 6.5% stake of the vegan beef maker but divested it in the run up to the IPO, with the aim of launching its own plant based protein line. This gives valuable insight into how other conventional meat companies too may react to the threat of alternatives in the future. Meanwhile, in the latest win for another Bill Gates-backed venture, Impossible Foods, popular fast food chain Burger King added its meatless patty to its menu across the nation as Impossible Whopper at the end of April.

On the other end of the spectrum sits lab-grown meat, grown in an artificial environment, using cultured cells from animals. Unveiled by Prof. Mark Post of the Dutch meat company Mosa Meat in 2013, the initial cost of a lab-developed burger was a whopping $325,000, which was funded by Google co-founder Sergey Brin. However, the sector has since then witnessed massive investments, reducing the cost of a burger to a mere $11 by 2019. There is rising interest from Asian countries too, with China signing a $300 million deal with Israeli high tech companies in 2017 to develop lab grown meat, while in March 2019 Singapore announced the allocation of SGD144 million for food-related innovation that includes biotech-based protein production, as the city-state targets producing 30% of its nutritional needs locally by 2030.

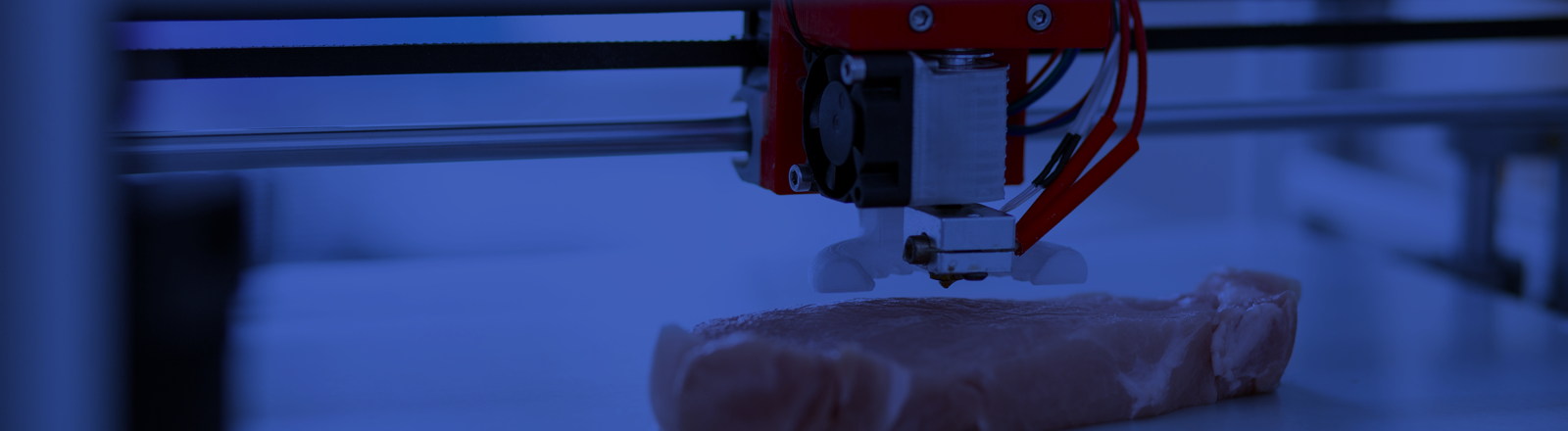

2. 3D food printing

Also radically transforming how we eat is 3D food printing, a market estimated to reach $525 million by 2023 according to BIS Research. 3D Systems Corporation, BeeHex, byFlow, and Natural Machines are some of the market leaders creating waves in this space. This up and coming sector opens up a wide range of possibilities with tailor-made nutrient content to match individual dietary needs, granting it the potential to be used as a tool to fight obesity, and even put an end to world hunger in the long run. For example, the Natural Machines is working on developing a residential-version of its currently commercial-scale machine Foodini, and allowing the users to set fat and calorie content as preferred. Furthermore, 3D food printing helps producers become incredibly efficient. For example, BeeHex and the company’s Chef 3D machine can now complete a pizza under just one minute. And thanks to lack of moisture, they also carry longer shelf life, enabling to be delivered to places with limited access to fresh food in the future.

3. Meal replacement products

Meal replacement is a supplement in the form of liquid (shake or soup) or bar that substitute for a meal of solid food. This market is driven by the increasing demand for convenience due to busy lifestyles, while also being used to counter health issues such as obesity and diabetes. Soylent, a household name in the industry, recently launched Soylent Squared, its latest product which is dubbed as the ‘mini meal’ as the snack bar carries 100 calories and 36 nutrients. It’s particularly targeted towards college students and young professionals; particularly clientele balancing multiple jobs, looking for affordable and healthy food on the go. Abbott Nutrition, Herbalife, Kellogg's, Nestlé and SlimFast are some other big names in the sector.

4. Blockchain

Blockchain solutions have been playing a vital role in transforming the supply chain and establishing consumer trust, particularly following a few high profile incidents in the past. The tech phenomenon helps consumers track the journey of their food from the point of origin, helping them verify the authenticity of their food on a farm-to-fork basis. The California-based seafood giant Bumble Bee Foods uses blockchain to track the journey of the yellowfin tuna it sells, helping the customers track the product from the point of capturing the fish to the point of the cans hitting the shelves, offering them highly accurate information. Following the 2018 E. coli romaine lettuce scandal, Walmart now tracks the information on the supply of its leafy green vegetables through a blockchain system it developed together with IBM.

5. Food robotics

Employed at a commercial level, this market is driven by increasing requirements for food safety regulations, growing need for reducing production costs and increased investment in automation and is estimated to reach $3.1 billion by 2025 according to a research report from Meticulous Market Research. Food robotics can be seen at all stages of food industry. The California-based Zume Pizza has automated its pizza making process through robots, to be done in a fraction of the time that would take a human to do it. The company received one round of funding worth $375 million from SoftBank and is awaiting another round worth $375 million to ramp up production. Meanwhile, the German automotive giant Continental is working on launching autonomous robot dogs that get deployed from driverless vehicles to deliver packages, while the Kiwibots from the Colombian startup Kiwi Campus are already at work delivering food to students and staff at University of California, Berkeley

At Acuity Knowledge Partners, our investment research team helps clients stay abreast of new investment frontiers, latest market trends and disruptive industry transformations for existing players. This includes deep-dive analyses, thematic research, and competitive landscape analyses. Our team of fundamental research experts and data experts can provide investment acumen by combining qualitative and quantitative data with research expertise to provide differentiated research insights.

What's your view?

Comments

15-Sep-2020 01:23:41 am

Like the way we think?

Next time we post something new, we'll send it to your inbox