Published on March 1, 2021 by Ankit Parwal

Key highlights

-

All key benchmark indices witnessed a bloodbath in early 2020, but rebounded dramatically. The S&P 500 traded at an all-time high during the year

-

Global financial markets have recovered much faster than they did after previous financial crises

-

Volatility reached its highest levels during the year and has now dropped to comfortable levels due to strong policies and positive investor sentiment

-

IPO markets had their strongest year in over a decade, despite fintech giant Ant Group’s IPO – the largest in the world – being suspended

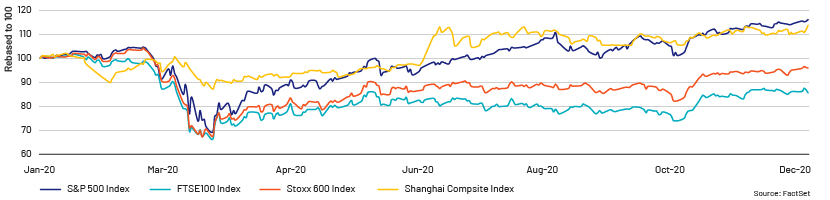

Performance of key indices

Major benchmark indices such as the S&P 500 and the Shanghai Composite Index recovered their losses and generated positive returns over the year. However, UK and European benchmark indices remained laggards and underperformed. The S&P 500 Index, which fell 31% at the start of the year, rebounded 67% from that level and outperformed all major indices. The technology sector performed the best, led by Apple, which overtook Saudi Aramco to become the world’s most valuable public listed company. The clear catalysts of stay-at-home orders and forced business closures boosted demand for workplace collaboration software, communication services, online learning tools, and telehealth and e-commerce platforms. Energy stocks rallied in November and December, fuelled by hopes of a vaccine, although the sector performed the worst during the year.

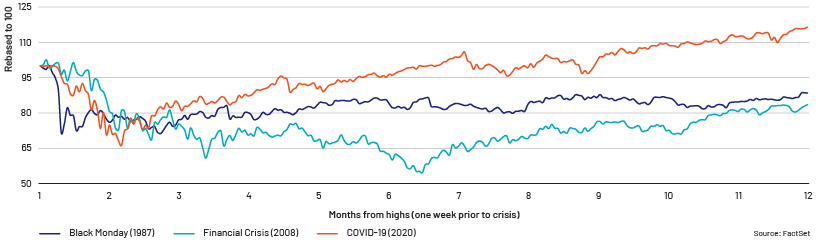

V-shape recovery vs recovery amid other black-swan events

A V-shape recovery refers to a sharp fall followed by a sharp rise. The S&P 500 Index fell sharply in early 2020 but rallied dramatically for the rest of the year. The sharp recovery was mainly due to strong macroeconomic policies, although the steep fall was not due to an economic depression or financial crisis. Amid previous global crises such as Black Monday (1987) and the global financial crisis (2008), the S&P 500 took far longer to recover. It remained subdued and took more than 12 months to recover the points it had lost, but amid the pandemic, it recovered points it had lost in less than six months and started generating positive returns.

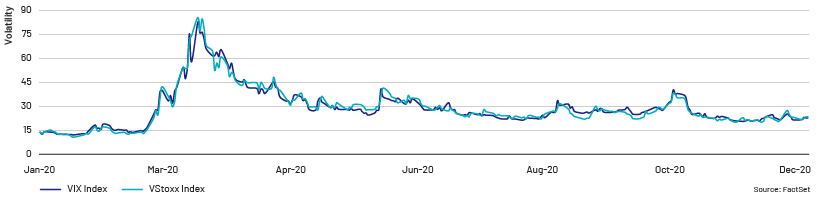

Volatility

The Volatility Index, also known as the “Fear Index”, measures the level of risk in the market. VIX Index is the popular name for the CBOE Volatility index, and VStoxx Index for the Euro Stoxx 50 Volatility Index. The VIX Index, which stood at 13.8 at the start of the year, reached an all-time high of 82.7 and fell to 21.5 at the end of the year due to strong policies, positive investor sentiment and vaccine development. The VStoxx Index, which stood at 14.0, peaked at 85.6 and fell to 23.2.

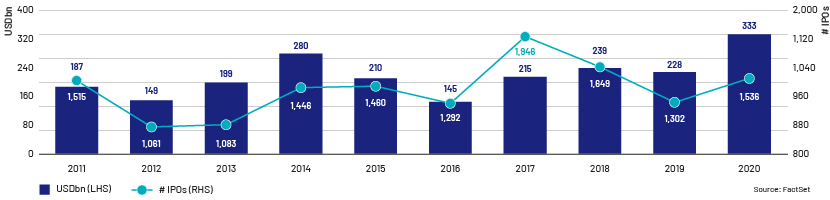

Global IPO activity

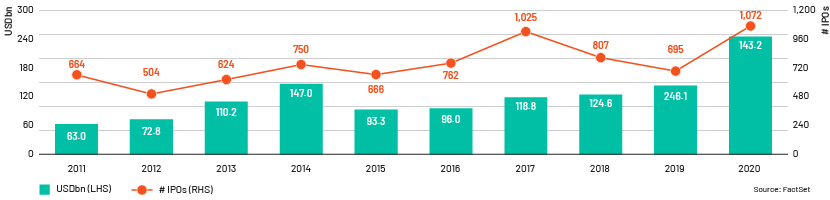

The IPO market was very active in 2020, with USD333bn raised on 1,536 deals. These were the highest proceeds raised in the past 10 years, and the number of deals the second highest. This would have been hard to imagine at the start of the year, when the pandemic forced global economies to lock down. Special-purpose acquisition company (SPAC) or “blank-cheque company” IPOs saw a marked increase. Such companies intend to buy other companies with the money they raise. Companies such as Pershing Square Tontine, Virgin Galactic, DraftKings and Nikola Motor went public through SPACs.

The second half of 2020 was the most active second half of the past 10 years by proceeds and by number of deals, two reasons being buoyant liquidity due to government policies and positive investor sentiment. Companies raised USD246bn via 1,072 transactions in 2H 2020. Both volume and the number of deals more than doubled from 1H 2020.

Ant Group’s much-awaited IPO was suspended last year. It was expected to be the world’s largest IPO ever, raising around USD37bn and surpassing Saudi Aramco’s proceeds of USD29bn. The Shanghai Stock Exchange decided to suspend the IPO, citing the likelihood of the company failing to meet information disclosure requirements a few days after the fintech giant's founder, Jack Ma, launched a public attack on the country's financial watchdogs and banks.

2021 outlook for equity markets

-

This year should be much better for equity investors. FactSet estimates that the S&P 500’s earnings will increase to c.USD165 per share in 2021, a significant increase of c.22% from c.USD136 per share last year. The forecast implies that 2021 earnings will exceed the 2019 level of c.160 per share as well. However, market valuation remains extremely high compared to previous years: the S&P 500 traded at a P/E of 27.5x in 2020 and is trading at a P/E of 22.6x in 2021.

-

Against all the odds, 2020 was a historic year for IPOs. Despite strong buoyancy in 2H 2020, many companies deferred their equity raising due to significant volatility and are likely to return in 2021. The mega IPO trend should continue this year, led by technology, healthcare and SPAC IPOs. Companies such as Coinbase (cryptocurrency exchange), Bumble (dating app), Instacart (grocery delivery app) and Roblox (online gaming platform) are scheduled to raise money this year.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of research and analytics to investment banks and advisory firms globally. We have a specific focus on ECM deals such as IPOs, rights issues, primary/secondary follow-ons, equity-linked convertibles and PIPE transactions. We partner with multiple investment banking teams, providing market knowledge, domain expertise and key insights in areas such as investor targeting, investor profiling, liquidity analysis, potential block sale analysis, market monitoring and updates, roadshows/conference presentations, IPO valuations, benchmarking and case studies.

Sources:

FactSet

IMF

Press releases

What's your view?

About the Author

Ankit Parwal has been working with Acuity investment banking team since 2010. He has been instrumental in setting up ECM and Corporate Access / ICM team for an European bulge bracket investment bank & transitioned processes from onshore teams. His current role involves working with partners and founders of boutique advisory clients advising them on M&A and Capital Market projects.

He has hands-on experience in M&A and ECM products including financial valuation models (DCF, LBO, Merger Model, Venture Capital Model etc.), pitchbooks, investor targeting, potential-blocks / stake sale analysis, liquidity analysis, IPOs, Rights issue..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox